Capital is bad, and operational expenditure is good as it’s a tax write off – right? When comparing Opex vs Capex, this couldn’t be further from the truth.

Most businesses, on just about every scale, will encounter the concepts of capital expenditure and operational expenditure. Both types of expenditure are necessary for any business. While both have different accounting considerations associated with them, ultimately it’s all about thinking ahead with how these can affect your profit margins, costs, and how they affect your income statement.

What Is Capital Expenditure?

Capital expenditure – or Capex – is essential to any operating company. From a business planning perspective, Capex is investment in the present for the purpose of generating future value. From a financial perspective, capital is the liquidity that can be used to cover short term liabilities of the business, as well as the physical assets owned by the company.

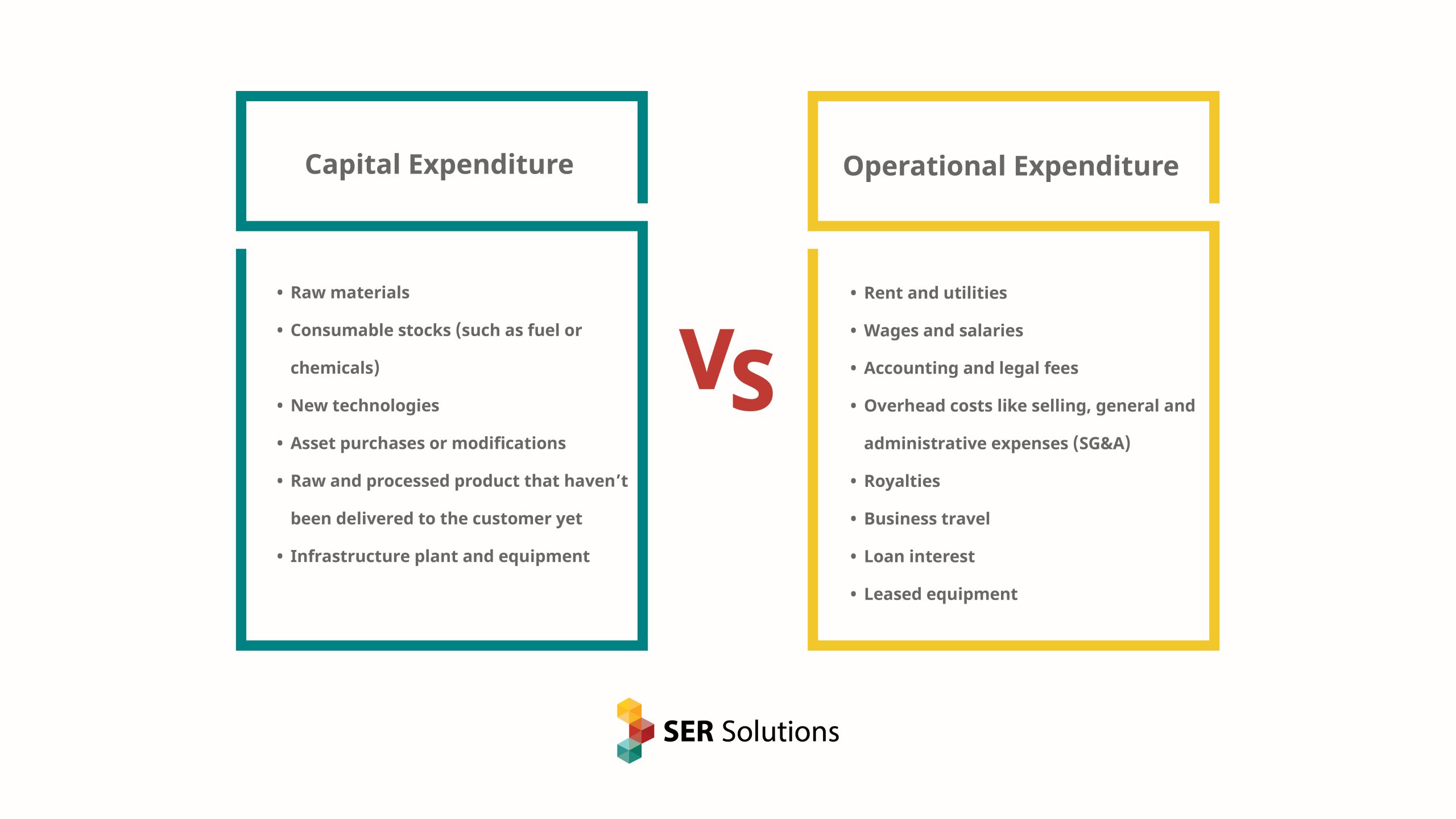

Examples of capital expenditure can include:

- Raw materials

- Consumable stocks (such as fuel or chemicals)

- New technologies

- Asset purchases or modifications

- Raw and processed product that haven’t been delivered to the customer yet

- Infrastructure plant and equipment

In a perfect world, capital is invested to acquire new, improved, or additional assets for expansion, new product manufacture, increase efficiency, all in order to add greater value to the existing business. Although the actual inclusions may vary depending on your industry – one way or another, capital should be seen as an investment to increase a company’s profit over the course of trading.

Significant consulting, planning and evaluation needs to be included when it comes to capital expenditure, as it often involves risk – is the investment going to pay off for your company, or is it going to fall flat? After all, knowledge is power.

The capital investment process should include queries like:

- What do we need to invest in?

- How much do we need to invest?

- How long is it going to take?

- What other options do we have to achieve the objective?

- What do we think we are going to get out of this?

Like most things, the more often you practice these types of evaluations – the easier it gets. Large scale operators who spend many millions per annum in capital investment certainly don’t “wing it”, and nor should you.

What Is Operational Expenditure?

Operational expenditure, or Opex, is what’s involved in the short term, day to day trading, as opposed to long term Capital investments.

Common examples of operational expenditure can include:

- Rent and utilities

- Wages and salaries

- Accounting and legal fees

- Overhead costs like selling, general and administrative expenses (SG&A)

- Property taxes

- Business travel

- Loan interest

- Leasing equipment instead of purchasing it

In operating expenditure, we actually look at the cost of the day to day running of the business – and this includes all of the administrative, overhead and cost of goods sold expenses required to produce revenue and profit. In broader terms, this is whatever it takes for the business to make its product, sell its product and generate its revenue.

Opex is often viewed as more desirable, because of its taxation treatment. Being tax deductible, there is an impression that the expenditure is ‘good’. Capital is not so, because there’s not the same immediate tax benefit. This limited and understanding of the two cost streams to the organization is unhelpful in understanding their relative contribution to long term vale.

A well disciplined organsiation will maximise the return (and efficiency) of their well planned and executed capital investments and constrain their operating costs to only those necessary to deliver the targeted performance.

Opex vs Capex – What Should You Focus On?

Instead of thinking in the short term (increasing operational costs in order to claw it all back via tax breaks) – consider an alternative perspective.

In order to lay a solid foundation when it comes to maximising profit over a lifetime of trading, businesses and operators should invest their capital wisely at the beginning of any financial cycle. One of the very best ways in doing just that, is by reducing the operating expenditure on all of the variables that go into producing and selling your product or service.

The lower the Opex cost and providing that the price of the product stays relatively consistent, the better off the business will be in the long term. After all – what is the point of years of blood, sweat and tears if the profit margins and income aren’t reflecting this? It’s also worth noting that this concept can be applied to just about any industry, no matter the size or scale of your business.

When it comes to examining the pros and cons associated with opex vs capex, it’s as simple as this – capital investment is outlaying for future profits, and operating expenditure is the cost of making those profits. If you’re ready to do just that for your business, then it might be time to speak to a professional.

Peter Crane has spent thirty years working with Tier One operating companies, assisting them deliver efficient capital investments, reducing waste, improving their performance and increasing investor confidence. Armed with practical experience in engineering services, capital planning, project delivery, construction management and strategic asset management within the infrastructure and resources sector, Peter offers a unique insight into operational roadblocks – and how to fix them.

If you are interested in educating yourself on how the capital investment lifecycle model works, then why not schedule a discovery call with Peter and the team at SER Solutions today.